Recent Articles

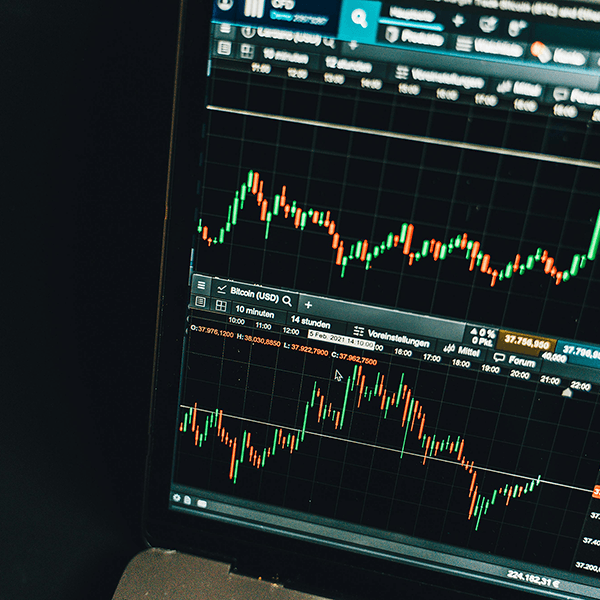

What Today’s Jobs Report Means for Mortgage Rates

Mortgage rates held steady after a mixed jobs report, with unemployment rising and job growth coming in stronger than expected. Learn what this means for homebuyers and what to watch next.

Published on 11/21/2025

50-Year Mortgages? Here’s What You Need to Know

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

Fannie Mae’s Big Update: You May Qualify Even With a Credit Score Below 620

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

What’s Going On With Mortgage Rates? (Explain-It-to-a-5th-Grader Version)

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

Down Payment Assistance: Your Key to Affordable Homeownership

Buying a home can feel overwhelming, especially with high down payment costs. Discover how down payment assistance can make homeownership possible for you.

Published on 10/27/2025

Eliminate PMI: Your Guide to Lower Monthly Payments and Save More

Want to lighten your monthly bills? Discover how removing PMI can boost your budget and pave the way to homeownership with less stress and more savings!

Published on 10/24/2025

Mortgage Rates Hold Near Yearly Lows as Market Awaits Next Data

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Published on 10/22/2025

Gen Z and the Dream of Homeownership: Adapting to a Challenging Market

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Published on 10/15/2025

Navigate the Journey: Your Essential Guide to First-Time Home Buying

Buying your first home can feel like a maze, but fear not! We’ll guide you through every twist and turn, making the process fun, simple, and stress-free.

Published on 10/12/2025

Mortgage Rates Tick Up Slightly as Bonds Weaken and MBS Underperform

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

3 Reasons Home Affordability Is Improving This Fall

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

Discover Your Path to Homeownership with Little or No Money Down

Ready to own your dream home without draining your savings? We’ll guide you through smart options that make it possible—so you can say goodbye to renting!

Published on 09/24/2025

Mortgage Rates Hit Yearly Lows—Then Jump After the Fed Cut. Here’s What Happened (and Why Applications Just Surged)

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

Simplify Your Finances: Discover How Refinancing Can Consolidate Debt

Are rising bills stressing you out? Refinancing can lower your monthly payments and help you pay off debt faster, making your financial life easier.

Published on 09/15/2025

Mortgage Rates Near 11 Month Lows—What’s Next With the Fed?

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Understanding FHA Loans: Your Path to Affordable Homeownership Made Easy

Dreaming of owning a home but worried about costs? FHA loans can be your secret weapon! Discover how these loans simplify the path to homeownership today!

Published on 09/09/2025

Buy or Rent: Making the Right Choice for Your Future

Wondering if buying or renting is best for you? Discover the key factors to help you make an informed decision that suits your lifestyle and finances.

Published on 09/04/2025

Why Mortgage Rates Move: What Every Homebuyer Should Know

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

Transform Your Credit: Pathways to Homeownership for Every Buyer

Unlock the door to your dream home! Discover simple, effective ways to boost your credit and conquer obstacles on your journey to homeownership.

Published on 08/28/2025